Understanding UPI App Development Costs and Its Benefits

In today's rapidly evolving digital economy, the Unified Payments Interface (UPI) has become more than just a payment solution—it's a fundamental pillar of India’s financial infrastructure. With the power to facilitate real-time bank transfers, UPI has eliminated the need for cash or traditional card transactions, making digital payments more accessible than ever. The National Payments Corporation of India (NPCI) launched UPI in 2016, and since then, it has grown substantially. Initially, it started with only 0.09 million transactions in its first three months and just 21 participating banks. However, this modest beginning has paved the way for UPI’s current stature, processing over $20,000 billion in transactions annually and boasting the support of around 598 banks. This impressive growth has positioned UPI as one of the fastest-growing digital payment systems globally, gaining international recognition.

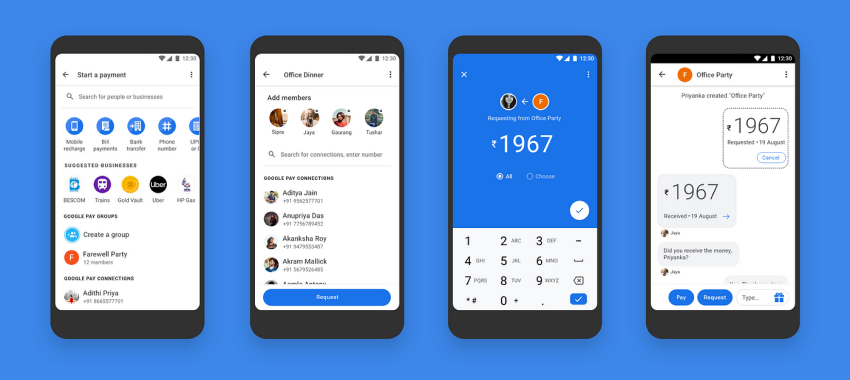

The global expansion of UPI is equally noteworthy, with countries like Sri Lanka, Mauritius, UAE, Singapore, and Nepal adopting UPI technology to streamline their own payment systems. Even prominent nations such as Australia, Canada, the UK, and Germany have recognized the advantages of UPI and are now integrating UPI payment services. The success of UPI has also led to a surge in UPI app development, with several third-party apps like Google Pay, PhonePe, Paytm, and Amazon Pay building their own UPI mobile apps to serve the growing demand for instant and secure payments.

The continuous growth and widespread adoption of payment app development centered around UPI are evident, with India alone witnessing over 10 billion monthly transactions in 2024. As businesses and startups look to tap into this expansive ecosystem, investing in UPI app development is becoming a critical strategy to ensure operational efficiency, enhance customer satisfaction, and stay competitive in a fast-moving digital world. This article will explore the complexities of UPI payment app development, including its costs, benefits, and the emerging trends shaping the future of UPI mobile apps, and why it remains an attractive investment for developers and businesses worldwide.

What is UPI and Why Does It Matter?

The Unified Payments Interface (UPI) is a transformative real-time payment system developed by the National Payments Corporation of India (NPCI) that enables seamless, instantaneous bank-to-bank transfers using a smartphone. By linking bank accounts through a UPI mobile app, users can perform digital transactions 24/7 without the need for physical cards or cash. UPI’s simplicity, security, and scalability have made it a game-changer in the payments landscape, significantly enhancing digital transactions. The ease of use, coupled with robust security features such as two-factor authentication and tokenization, has built trust among users. As a result, UPI app development has seen an exponential rise, with numerous third-party apps like Google Pay, PhonePe, and Paytm offering UPI-enabled services. This surge in payment app development has not only contributed to financial inclusion by providing easy access to digital payments for a vast population but has also helped drive the growth of India’s digital economy. Furthermore, the global adoption of UPI, with several countries now embracing its benefits, has solidified its position as a key player in the international payments ecosystem. With its low cost and efficient processing, UPI payment app development continues to be a vital tool for both businesses and individuals, reshaping how payments are made globally.

How Does a UPI App Facilitate Seamless Digital Payments?

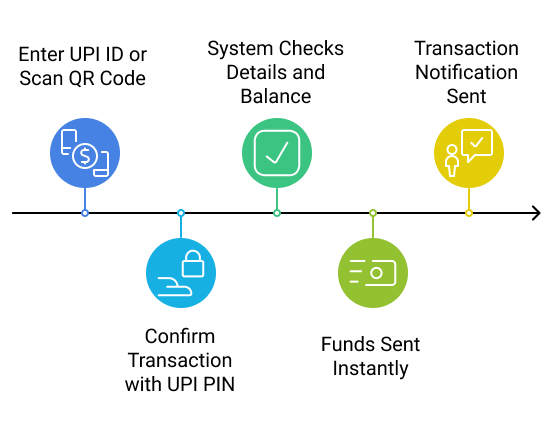

A UPI app works by connecting users directly to their bank accounts via the Unified Payments Interface (UPI), a system developed by the National Payments Corporation of India (NPCI) that facilitates real-time, secure financial transactions. The first step in using a UPI payment app is to register by linking a bank account and creating a UPI ID (also known as a Virtual Payment Address, or VPA) along with a UPI PIN for security. Once the account is set up, users can easily send money by entering the recipient’s UPI ID or phone number, specifying the amount, and confirming the transaction using their UPI PIN. This ensures that each payment is authenticated and authorized before processing. The payment request is sent to the bank’s UPI gateway, where it is validated and processed.

The UPI mobile app immediately checks whether the sender has enough funds and sends the transaction for approval. If everything is in order, the funds are transferred instantly from the sender’s bank account to the recipient’s bank account, typically within seconds. To ensure security, payment app development integrates various protective measures, including end-to-end encryption, two-factor authentication, tokenization of sensitive data, and fraud detection systems that monitor for suspicious activity. After the transaction is completed, users receive a confirmation notification and a digital receipt. This rapid and secure process makes UPI one of the most popular payment methods in India today, as it combines convenience and high-level security, making it an essential feature of UPI app development.

Key Features of UPI

- Interoperability: Users can transact across banks and apps without barriers.

- Instant Transactions: Real-time settlements reduce delays.

- Wide Application: From bill payments to e-commerce and QR-based merchant payments, UPI caters to diverse use cases.

Current Trends in UPI Mobile App Development

The growth of UPI has spurred a wave of innovations in UPI mobile app and payment app development. Some key trends include:

UPI Lite: Introduced for small-ticket transactions, UPI Lite boasts a 99.9% success rate, even during peak hours.

Global Expansion: India has partnered with countries like Singapore and UAE to extend UPI services internationally, creating opportunities for cross-border UPI payment app development.

Dominance of Major Players: Apps like PhonePe (48.3% market share), Google Pay (37%), and Paytm lead the UPI app ecosystem, handling over 95% of transaction values.

AI Integration: Advanced UPI mobile apps now use AI for fraud detection, personalized recommendations, and voice-assisted transactions.

Government Initiatives: With initiatives like the Digital India campaign, UPI apps are set to become more inclusive, offering services to rural and semi-urban users

Benefits of UPI Payment App Development

Investing in a UPI payment app can provide substantial returns in terms of user engagement, operational efficiency, and business scalability. Key benefits include

1. Customer Convenience:

A UPI mobile app offers an intuitive interface, enabling users to transact effortlessly across multiple banks and merchants. Features like QR code scanning and contactless payments enhance user satisfaction.

2. Revenue Potential:

Businesses integrating UPI often witness increased customer retention. E-commerce platforms, for instance, report higher conversion rates when offering UPI as a payment option.

3. Operational Efficiency:

Automating payments reduces dependency on manual cash handling, minimizing errors and improving cash flow management.

4. Data Insights:

Payment app development enables businesses to collect transactional data, offering insights into consumer behavior and preferences.

5. Enhanced Security:

UPI apps employ multi-layer encryption, tokenization, and real-time fraud detection, ensuring robust transaction security.

How Secure Are UPI Apps and Their Transactions?

The UPI app development ecosystem is built on strong security measures to ensure safe digital transactions. UPI, known for its seamless real-time payment system, employs various technologies to protect both users and businesses from fraud. Here’s an overview of the security measures and best practices in place for UPI payment app development.

Key Security Features

End-to-End Encryption: UPI transactions are encrypted to prevent data from being intercepted during transmission.

Two-Factor Authentication (2FA): Users authenticate their transactions with a UPI PIN and device security, adding an extra layer of protection.

Tokenization: Sensitive data like bank details are replaced with unique tokens, enhancing security by reducing the risk of data theft.

AI-Based Fraud Detection: Many UPI mobile apps integrate AI algorithms that monitor transaction patterns, flagging suspicious activities before they are completed.

Emerging Opportunities

- Small Business Enablement: Apps like PhonePe focus on digitizing small merchants, creating a roadmap for new entrants.

- Voice-Assisted Payments: AI-powered features are gaining traction, particularly for accessibility.

Cross-Border Transactions: UPI’s integration with international payment systems presents vast opportunities for global apps.

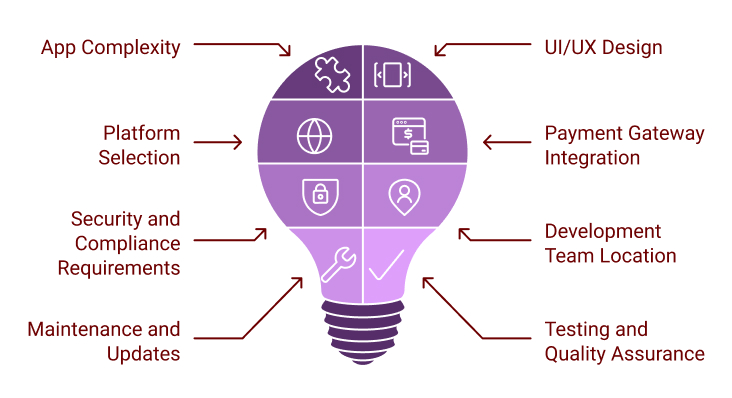

Factors Affecting UPI App Development Costs

Developing a UPI mobile app is a complex process, influenced by various factors that can impact the overall cost. Here’s an outline of the key elements involved in UPI app development, UPI payment app development, and payment app development that contribute to the overall expense

1. App Complexity

The complexity of the app is one of the most significant factors affecting the cost. Simple payment app development that offers basic UPI features such as balance checks, payments, and transaction history will generally cost less than apps with advanced features like:

- AI-powered fraud detection

- Customizable dashboards

- Integrated loyalty programs

- Multiple payment gateways

More sophisticated functionalities, such as integration with third-party services or cross-platform compatibility, will require more development time and expertise, which directly raises the cost.

| Feature | Cost Estimate | Description |

|---|---|---|

| Basic UPI Integration | $5,000–$10,000 | Includes linking bank accounts, creating UPI IDs, and supporting simple transfers. |

| Transaction History | $2,000–$5,000 | Displays past transactions, with filtering and sorting capabilities. |

| QR Code Payments | $3,000–$7,000 | Generates and scans QR codes for seamless payments |

| Multiple Payment Gateways Integration | $5,000–$15,000 | Supports different gateways to increase payment flexibility and reliability. |

| AI-Based Fraud Detection | $8,000–$20,000 | Integrates AI algorithms to monitor and flag suspicious activities. |

| Loyalty Programs and Cashback Systems | $7,000–$15,000 | Rewards users with cashback and points for transactions to improve user retention. |

| Multilingual Support | $3,000–$8,000 | Allows users to access the app in multiple languages. |

| Voice-Activated Transactions | $5,000–$10,000 | Enables voice commands for initiating transactions. |

| In-App Chat Support | $4,000–$10,000 | Offers customer service via chat for issue resolution. |

| Analytics Dashboard | $10,000–$25,000 | Provides insights into user behavior, transaction patterns, and app performance. |

2. UI/UX Design

The design of a UPI mobile app plays a crucial role in user adoption. High-quality, intuitive user interface (UI) and user experience (UX) design ensure the app is both user-friendly and visually appealing, which increases the development time and cost. Custom design elements or complex animations require more resources.

Basic UI/UX Design: $5,000–$10,000 (Simple layouts, minimal animations).

Intermediate UI/UX Design: $10,000–$20,000 (Custom elements, seamless navigation, interactive UI).

Advanced UI/UX Design: $20,000–$40,000 (High-end animations, gamified elements, and personalized user journeys).

3. Platform Selection (Android vs. iOS vs. Cross-Platform)

Deciding whether to build a native UPI payment app development for Android or iOS or go for a cross-platform solution (using frameworks like Flutter or React Native) can significantly influence costs:

- Native apps require separate development for both Android and iOS, making them more expensive.

- Cross-platform apps can be more cost-effective, as they share most of the codebase between platforms.

| Platform | Cost Estimate | Description |

|---|---|---|

| Android (Native) | $15,000–$30,000 | Requires Kotlin/Java expertise. |

| iOS (Native) | $20,000–$35,000 | Requires Swift/Objective-C expertise. |

| Cross-Platform | $25,000–$50,000 | Uses frameworks like Flutter or React Native for shared codebases. |

4. Payment Gateway Integration

Integrating secure and reliable payment gateways is essential in any payment app development. The cost of integrating these services depends on:

- The number of gateways you want to integrate.

- The level of security required, such as compliance with PCI-DSS standards.

- Customization needs to handle specific transaction types or currencies.

For a UPI mobile app, integrating with India’s UPI infrastructure requires adhering to the NPCI guidelines and undergoing regulatory approvals, which can add to the cost.

5. Security and Compliance Requirements

Security is a top priority in UPI payment app development due to the sensitive financial data involved. Implementing security measures such as:

- End-to-End Encryption: $3,000–$8,000.

- Two-Factor Authentication: $5,000–$12,000.

- Tokenization: $4,000–$10,000.

- Fraud Detection System: $8,000–$20,000.

- Regulatory Compliance (NPCI, RBI): $10,000–$15,000 for approvals and audits.

These security measures require specialized expertise and can increase development costs. Additionally, the app must comply with regulatory standards such as those set by the RBI and NPCI, which can add further compliance costs.

6. Development Team Location

Your development team's location is another factor that can impact the cost. Developers based in places with lower labour costs (like Eastern Europe or India) will charge less than their counterparts based in nations with higher labour costs (like the United States or Western Europe). Here's a breakdown:

| Location | Hourly Rate | Estimated Cost |

|---|---|---|

| India/Eastern Europe | $15–$85/hour | $20,000–$75,000 for medium complexity apps. |

| North America/Western Europe | $50–$240/hour | $50,000–$150,000 for medium complexity apps. |

Choosing an offshore or nearshore development team can help reduce costs while still maintaining quality, provided the right security and regulatory compliance measures are followed.

7. Maintenance and Updates

Once the app is developed, ongoing maintenance is crucial to ensure its smooth operation. Regular updates, security patches, bug fixes, and the addition of new features will incur additional costs. The cost of maintenance is typically 15-20% of the initial development cost annually.

Annual Maintenance Costs: Typically 15–20% of the initial development cost.

- Basic App: $5,000–$10,000/year.

- Advanced App: $15,000–$30,000/year.

8. Testing and Quality Assurance

Quality assurance (QA) and rigorous testing are essential in payment app development to ensure the app functions smoothly and securely. The cost will vary depending on:

- The total amount of testing steps (UAT, unit, integration, etc.).

- The tools and frameworks used for testing.

- The complexity of the app’s functionality.

9. Marketing and User Acquisition

While not directly related to UPI app development, a significant portion of the overall cost can be allocated to marketing and user acquisition. Launching a UPI mobile app typically involves campaigns to promote the app and drive downloads. Depending on your strategy (social media marketing, influencers, paid ads), this can significantly affect the overall budget.

App Store Optimization (ASO): $2,000–$5,000.

Social Media Campaigns: $5,000–$15,000/month.

Influencer Marketing: $1,000–$10,000 per campaign (depending on influencer reach).

In conclusion, investing in UPI app development provides significant benefits for businesses, ranging from enhanced customer convenience to improved operational efficiency. By understanding the costs involved and leveraging the capabilities of UPI, businesses can tap into a seamless, scalable, and secure payment solution. Akkenna Animation and Technologies specialize in developing top-tier UPI mobile apps, ensuring that your business stays at the forefront of the digital payments landscape. With their expertise in mobile app development, Akkenna delivers secure, efficient, and high-performance UPI apps tailored to meet your business needs, making them the ideal partner for businesses aiming to thrive in the ever-evolving digital economy.

Frequently Asked Questions About UPI Payment App Development

Key features include interoperability across banks, real-time transaction processing, QR code payments, and security measures such as two-factor authentication and encryption.

UPI apps use end-to-end encryption, two-factor authentication, tokenization, and AI-powered fraud detection to ensure secure transactions.

Costs vary based on the app's complexity, platform (Android, iOS), design, security features, third-party integrations, and ongoing maintenance. Basic apps cost less, while apps with advanced features like AI integration and cross-platform compatibility are more expensive.

UPI apps offer operational efficiency, enhanced customer convenience, and increased revenue potential. With the growing trend of digital payments, UPI apps are essential for staying competitive in today’s digital economy.

UPI has expanded internationally, with countries like Singapore and the UAE adopting UPI for their own payment systems. This opens opportunities for businesses to integrate UPI into global payment platforms.

Common challenges include ensuring security compliance (e.g., PCI-DSS), meeting regulatory standards, integrating with multiple payment gateways, and managing complex app features.

UPI payment apps offer faster transactions, reduced cash handling, improved cash flow management, and enhanced customer retention. They also provide valuable data insights into consumer behavior and spending patterns.

UPI Lite is designed for small-ticket transactions and offers a higher success rate during peak hours. It makes low-value payments faster and more efficient, even when the network is congested.

UPI apps make digital payments accessible to a broader audience, including those in rural and semi-urban areas, helping to drive financial inclusion by offering an easy, secure way to transact without the need for physical cards or bank branches.

UPI is expanding globally, and certain UPI apps can be used for cross-border transactions. Countries like Singapore, UAE, and Mauritius have integrated UPI, enabling users to make international payments seamlessly.

The timeline for UPI app development depends on the complexity and features of the app. A basic app can take a few months to develop, while more advanced apps with custom features, security measures, and cross-platform compatibility may take longer.

The success of a UPI payment app depends on factors like user experience (UI/UX), security features, seamless integration with banks and payment gateways, effective marketing, and customer support.

Subhashree Pandian

An ambitious content creator with a love for digital marketing, I enjoy developing content that reflects my personal touch and learning. Storytelling and sharing unique ideas are at the heart of what I do.